Unbranded packet food to attract GST

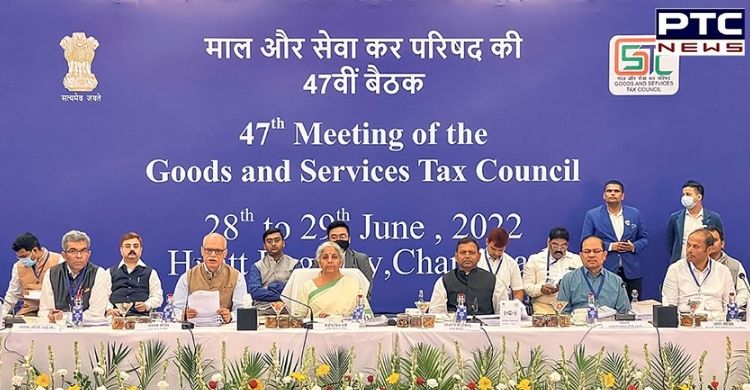

Chandigarh, June 29: The GST Council approved the recommendations of a panel of ministers on Tuesday to eliminate exemptions on a variety of goods and services, including several unbranded packaged food items, which were causing widespread duty evasion.

According to reports, hotel rooms costing less than Rs 1,000 a night and non-ICU hospital beds costing more than a certain amount may be subject to the five-year-old GST. All hotel rooms will now be subject to a 12% tax.

On the second day of the two-day meeting of the all-powerful body comprised of state and Union finance ministers, the contentious issues of extending the compensation period for states beyond five years and imposing a 28 percent levy on casinos and online gaming will be debated.

According to reports, hotel rooms costing less than Rs 1,000 a night and non-ICU hospital beds costing more than a certain amount may be subject to the five-year-old GST. All hotel rooms will now be subject to a 12% tax.

On the second day of the two-day meeting of the all-powerful body comprised of state and Union finance ministers, the contentious issues of extending the compensation period for states beyond five years and imposing a 28 percent levy on casinos and online gaming will be debated.

On Tuesday, many procedural adjustments were also addressed in order to make the system more resilient and to improve checks, considering that GST has previously been prone to evasion.

Also Read | Udaipur beheading incident: Section 144 imposed across Rajasthan for one month; probe on

On Tuesday, many procedural adjustments were also addressed in order to make the system more resilient and to improve checks, considering that GST has previously been prone to evasion.

Also Read | Udaipur beheading incident: Section 144 imposed across Rajasthan for one month; probe on

While the group of ministers' recommendations on rate rationalisation have yet to be submitted, the GST Council has taken up several changes related to the removal of exemptions or 'nil' levy, which were resulting in tax evasion or rule circumvention, as well as causing operational problems for authorities.

While the group of ministers' recommendations on rate rationalisation have yet to be submitted, the GST Council has taken up several changes related to the removal of exemptions or 'nil' levy, which were resulting in tax evasion or rule circumvention, as well as causing operational problems for authorities.

Similarly, the plan to eliminate the inverted duty structure on specific commodities - where the charge on the end product is lower than the levy on the intermediaries - will take effect with the details announced by finance minister Nirmala Sitharaman on Wednesday. This might include items such as edible oil and Led bulbs.

Also Read | Punjab Board declares Class 12th Results

-PTC News

Similarly, the plan to eliminate the inverted duty structure on specific commodities - where the charge on the end product is lower than the levy on the intermediaries - will take effect with the details announced by finance minister Nirmala Sitharaman on Wednesday. This might include items such as edible oil and Led bulbs.

Also Read | Punjab Board declares Class 12th Results

-PTC News