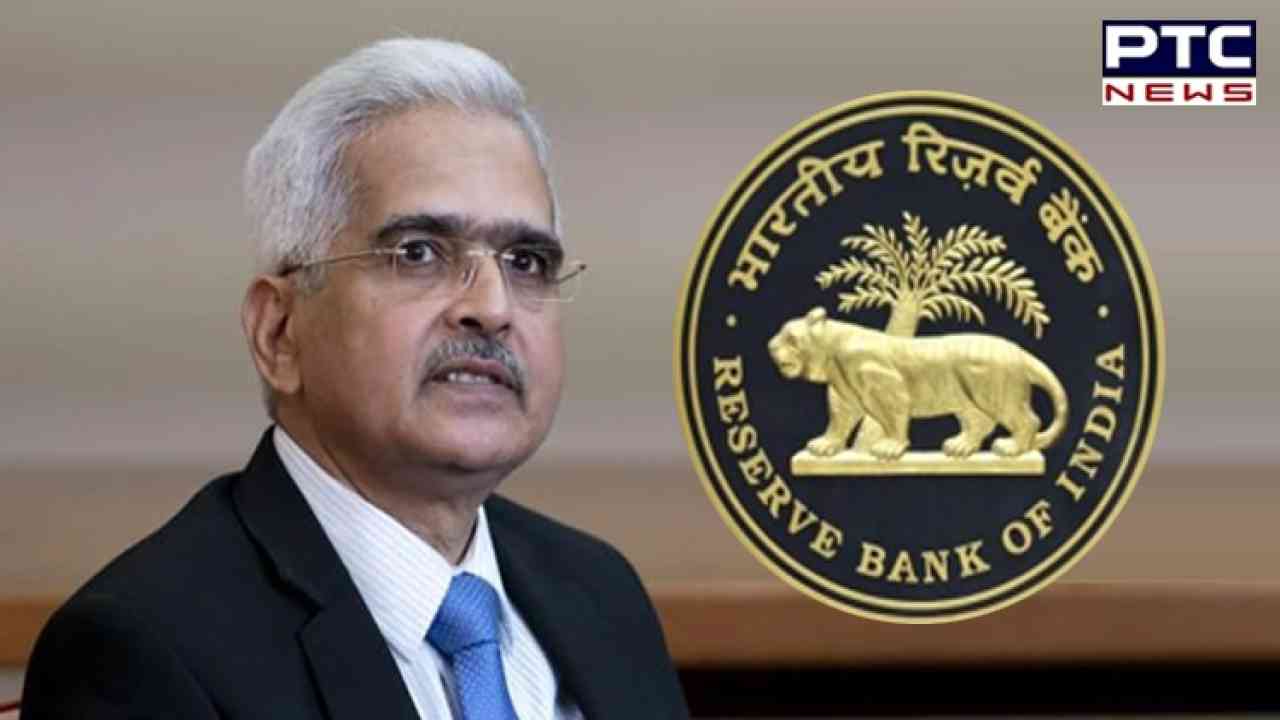

RBI Monetary Policy: Repo rate remains unchanged at 6.5% as inflation softens

RBI Monetary Policy: The Reserve Bank of India's (RBI) monetary policy committee (MPC) has decided to keep the repo rate unchanged at 6.5%, RBI governor Shaktikanta Das said on Thursday.

The second bimonthly monetary policy meeting for fiscal 2023-24 took place over a three-day period commencing on Tuesday, June 6, and finishing on Thursday, June 8.

The repo rate is the interest rate at which the RBI loans to other banks. A steady decrease in inflation (now at an 18-month low) and the possibility of additional decline may have motivated the central bank to put the brake on the key interest rate again.

Most analysts predicted that the RBI will maintain the repo rate unchanged.

Many countries, particularly sophisticated economies, have been concerned about inflation, but India has managed to steer its inflation trajectory very successfully.

The RBI delayed the repo rate during its April meeting, the first in 2023-24.

With the exception of the April pause, the RBI has hiked the repo rate by 250 basis points to 6.5 percent since May 2022 in order to combat inflation.

Raising interest rates is a monetary policy instrument that normally helps to reduce demand in the economy, allowing the inflation rate to fall.

Also Read | Another Shraddha Walkar-like case: Mumbai man kills live-in-partner, chops body into pieces

- PTC NEWS